Better Wyoming Action + Research played a pivotal role in informing voters across the state about what, exactly, “Amendment A” on their ballot was all about.

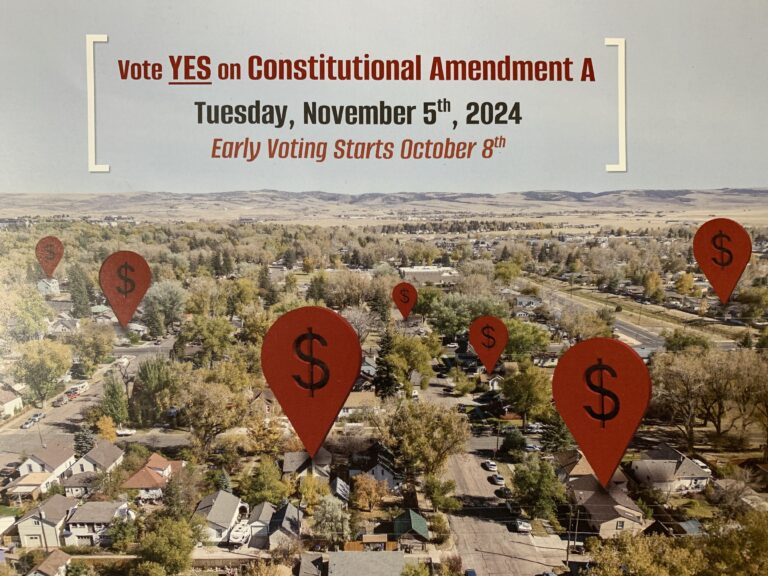

The Wyoming Realtor’s Association spent considerable sums on mailers supporting the amendment, which proposed to split owner-occupied residential property into a separate category from second homes and commercial property.

But the mailers’ language was aimed to persuade, not inform, and many voters were left scratching their heads about exactly what the amendment would do.

The week before the general election, BWAR used its peer-to-peer text message program to provide clarification and educate voters about why Amendment A was a smart policy to support.

We sent text messages to 130,000 Wyoming voters with a brief message and linking to a Better Wyoming article that went more in-depth.

This outreach helped inform and encourage voters, and Amendment A passed on Election Day, with nearly 60 percent of ballots cast in its favor.

Now, when the Wyoming Legislature convenes in January, lawmakers will be able to lower residential property taxes in a narrower manner, allowing for relief where it’s needed without giving tax breaks to corporations or luxury second homeowners.